Introduction: A New Era of Optimism in Real Estate

The global real estate landscape is witnessing an unprecedented shift, fueled by the strategic investment plans of dealmakers who are shuffling billions of dollars into the market. As reported by CoStar, this influx of capital is reshaping the outlook for the remainder of 2025.

Massive Capital Flows and Their Impact

Why Are Dealmakers Investing Billions?

Several factors have converged to inspire confidence among dealmakers, leading them to pour billions into the real estate sector. These include:

- Favorable Market Conditions: Stabilized property prices after recent dips, coupled with pent-up demand, encourage investors to make bold moves.

- Interest Rate Environment: Historically low interest rates make borrowing cheaper, spurring more investments in commercial and residential properties.

- Economic Recovery Signs: Positive indicators such as job growth and GDP expansion foster optimism about future asset appreciation.

- Inflation Hedge: Real estate remains a key asset to hedge against inflation, prompting large-scale investments.

Major Investment Trends Shaping the Future

Institutional Investors Stepping Up

Institutional players, including pension funds, sovereign wealth funds, and private equity firms, are actively reallocating their portfolios towards real estate. Their strategic deployment of capital aims to achieve long-term growth, diversification, and steady income streams. Some notable trends include:

- Investing heavily in **industrial warehouses** and logistics centers to capitalize on e-commerce growth.

- Purchasing **multifamily residential complexes** in urban cores to meet rising rental demand.

- Targeting **office spaces** in prime locations, despite some hesitancy due to hybrid work models.

Emergence of New Markets and Sectors

While traditional markets continue to thrive, dealmakers are also exploring emerging spaces, such as:

- Data centers: The rise of cloud computing has created a demand surge for data storage facilities.

- Healthcare real estate: Hospitals, senior living facilities, and medical office buildings are gaining traction among investors.

- Alternative properties: Student housing, self-storage units, and leisure resorts are seeing a revival as investors diversify their holdings.

Technological Advancements Driving Investment Decisions

Advanced data analytics, AI, and virtual reality are transforming how dealmakers evaluate potential investments. These tools allow for more precise risk assessment, market predictions, and asset management strategies. As a result, billions are being allocated with greater confidence, reducing uncertainties traditionally associated with large deals.

Global Economic Dynamics and Their Influence

The current global economic environment offers both challenges and opportunities for investors. While geopolitical tensions and currency fluctuations could pose risks, the overall resilience of the global economy supports the optimistic forecasts for 2025. Key points include:

- Emerging markets with rapid urbanization are attracting foreign investments.

- Stable economic policies in key regions bolster investor confidence.

- Diversification into international markets offers protection against localized downturns.

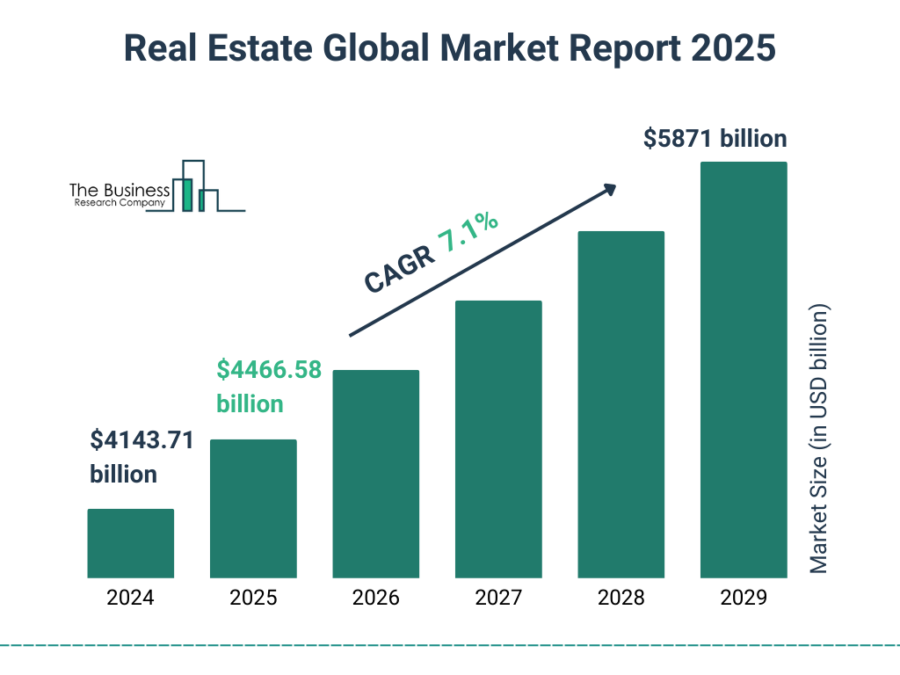

Forecasting 2025: What Can We Expect?

Experts predict that the influx of capital and strategic focus on high-growth sectors will lead to a robust real estate market in 2025. Anticipated outcomes include:

- Increased transaction volumes: Record-breaking deals are expected as more capital is channeled into prime and niche markets.

- Property value appreciation: Continued upward trajectory, particularly in urban centers with strong economic fundamentals.

- Innovation-driven developments: Incorporation of sustainable and smart technologies to enhance asset value and attract tenants/investors.

Challenges and Considerations

Despite optimism, there are potential hurdles that dealmakers need to navigate:

- Regulatory changes: New policies around zoning, taxes, and environmental standards could impact profitability.

- Market saturation: Excess capital might lead to inflated property prices, risking corrections.

- Global uncertainties: Political or economic crises can disrupt investments and growth patterns.

However, seasoned investors are adopting risk mitigation strategies, such as diversification and leveraging technological insights, to safeguard their portfolios.

Conclusion: A Bright Outlook for 2025

The strategic deployment of billions by dealmakers signifies a renewed vigor in the real estate sector. With favorable market conditions, technological innovations, and global economic stability, the outlook for the rest of 2025 appears promising. Investors and industry stakeholders who adapt to emerging trends and remain alert to potential risks will likely reap substantial benefits in this vibrant market landscape.

As the year progresses, ongoing developments will continue to shape the trajectory of real estate investments. The capital inflow not only boosts market confidence but also signals a transformative phase driven by strategic visionaries looking to capitalize on new opportunities across sectors and geographies.

For more updated news please keep visiting Prime News World.