Introduction: Navigating a Complex Market Landscape

The stock market continues to demonstrate its unpredictable nature, driven by a combination of macroeconomic factors, corporate performances, geopolitical developments, and sector-specific trends. Recent trading sessions have seen notable shifts, notably a dip in the Dow Jones Industrial Average following the S&P 500 reaching a second-highest level. Amidst this backdrop, key players like Nvidia, Kellogg, and emerging markets such as Brazil are capturing investor attention, signaling nuanced trends that could influence future market direction. Understanding these dynamics is crucial for investors seeking to make informed decisions in this volatile environment.

The Current State of the U.S. Stock Market

The Dow’s Slight Decline

The Dow Jones Industrial Average appears poised for a modest slip, reflecting investor caution amid mixed economic signals. While the broader S&P 500 recently closed at a near-record high, the Dow’s slight downturn indicates some skepticism among traders about sustained growth. This divergence highlights the varying sector performances and the importance of diversification.

The S&P 500’s Resilience

The S&P 500 finished at its second-highest level historically, underscoring the underlying strength in many sectors despite short-term fluctuations. Its ability to approach record highs suggests investor optimism about the overall economy, though not without hesitation. Factors such as strong corporate earnings, ongoing technological innovations, and resilience in consumer spending have contributed to this positive outlook.

Focus Areas: Nvidia, Kellogg, and Brazil

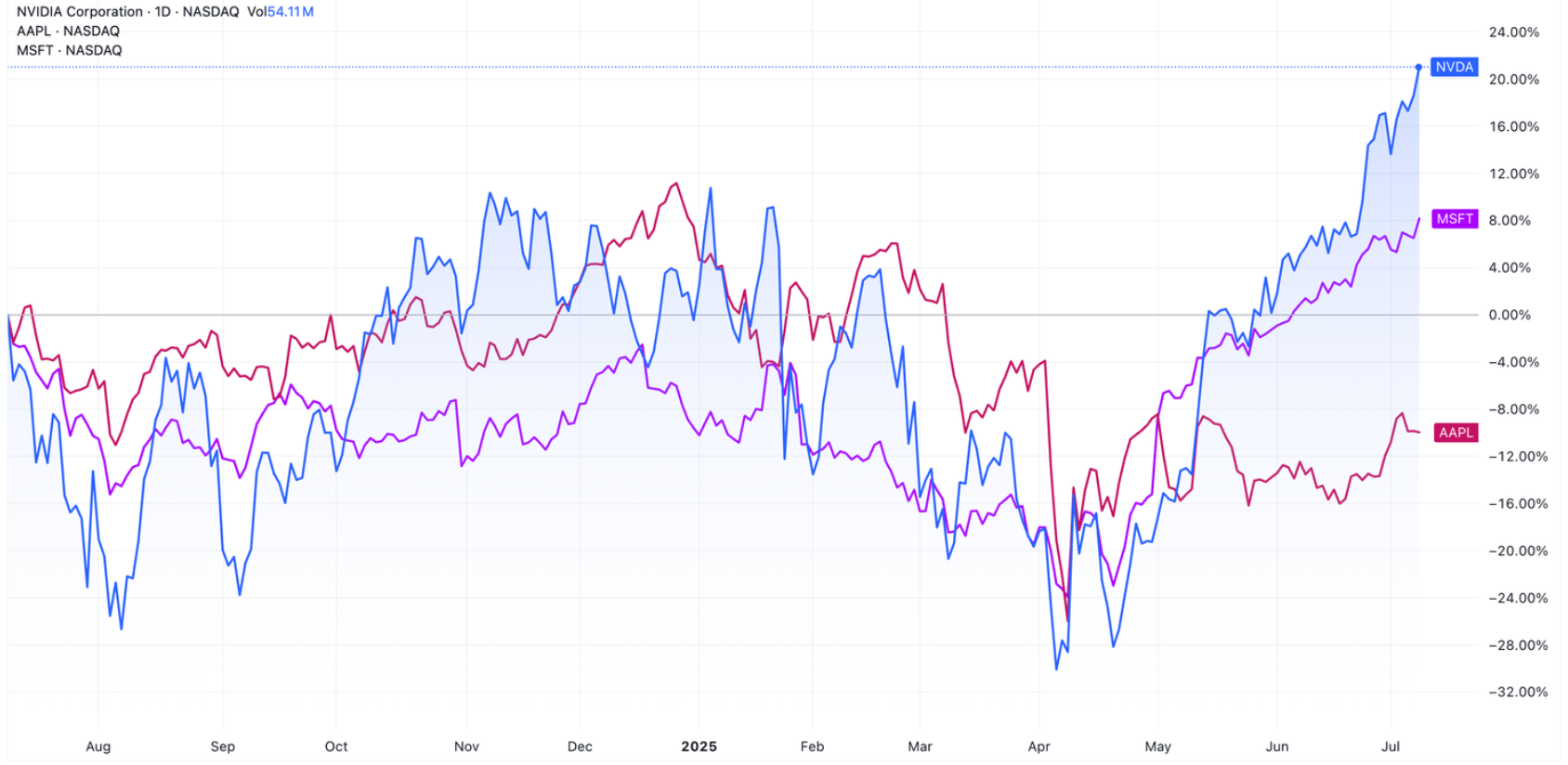

Nvidia: The Semiconductor Powerhouse

Nvidia continues to be a focal point for investors, fueled by its leadership in graphics processing units (GPUs), artificial intelligence (AI), and data center technologies. The company’s innovative advancements and strategic partnerships bolster its stock performance, making it a bellwether for the tech sector’s vitality. Recent earnings reports and product launches have further solidified Nvidia’s position as a critical driver of growth in the semiconductor space.

- Growth Drivers: AI deployment, gaming industry expansion, and data center demand.

- Market Sentiment: Optimistic, with analysts citing robust fundamentals and innovation pipelines.

- Risks: Supply chain disruptions, geopolitical tensions, and regulatory scrutiny in key markets.

W.K. Kellogg: Navigating Consumer Staples

Kellogg remains a vital player within the consumer staples sector, adept at adapting to shifting consumer preferences and global supply chain challenges. As the company focuses on innovation, product diversification, and expanding its global footprint, investor interest in Kellogg reflects confidence in its long-term growth prospects. Recent strategic initiatives, including brand revitalization and sustainability commitments, are expected to further enhance its market position.

- Innovations: New product lines catering to health-conscious consumers.

- Operational Focus: Cost efficiencies and distribution expansion.

- Challenges: Commodity price inflation and shifting consumer tastes.

Brazil: An Emerging Market with Growing Potential

Brazil continues to be on the radar for investors due to its emerging market growth potential, diversified economy, and strategic position within Latin America. Political developments, commodity prices, and foreign investment flows are key factors influencing its market sentiment. Recent political stability and renewed infrastructure investments could herald positive shifts, making Brazil an attractive destination for diversification.

- Economic Indicators: Improving GDP growth, rising commodity exports.

- Investment Climate: Reforms and increased foreign investment interest.

- Risks: Political uncertainties, currency fluctuations, and external shocks.

Key Market Drivers and Trends

Macroeconomic Factors Impacting Market Sentiment

Inflation rates, interest rate policies, and economic data releases continue to shape investor confidence. Recent signs of moderating inflation may reduce fears of aggressive rate hikes, supporting valuations in the near term. Conversely, persistent inflationary pressures could prompt central banks to maintain tighter monetary policies, which can suppress market rallies.

Corporate Earnings and Sector Performance

Strong earnings reports, especially from technology and consumer sectors, have propelled the market upward, yet some sectors face headwinds from rising input costs or regulatory challenges. Monitoring earnings expectations and sector rotations remains crucial for understanding market momentum.

Geopolitical and Global Market Influences

International developments—such as trade tensions, inflation in emerging markets, and commodities price volatility—introduce additional layers of complexity. For instance, China’s economic data and geopolitical tensions can indirectly impact U.S. stocks, especially those with supply chain linkages or international markets.

Implications for Investors

- Stay Diversified: Diversification across sectors and regions can mitigate risks associated with market swings.

- Focus on Fundamentals: Companies with strong balance sheets, innovation pipelines, and resilient business models are better positioned to withstand volatility.

- Monitor Key Indicators: Keep an eye on inflation, interest rates, and geopolitical developments for timely decision-making.

- Long-Term Perspective: Short-term fluctuations should be viewed as opportunities rather than setbacks, especially when fundamentals remain sound.

Conclusion: Preparing for Market Fluctuations

The current landscape is characterized by cautious optimism, with the market balancing between record highs and underlying uncertainties. Nvidia’s technological leadership, Kellogg’s strategic adaptability, and Brazil’s burgeoning growth showcase the diverse opportunities available, but also underline the importance of vigilance. As the market continues to navigate volatility, focusing on fundamentals, maintaining diversification, and staying informed will remain key to successful investing.

For more updated news please keep visiting Prime News World.