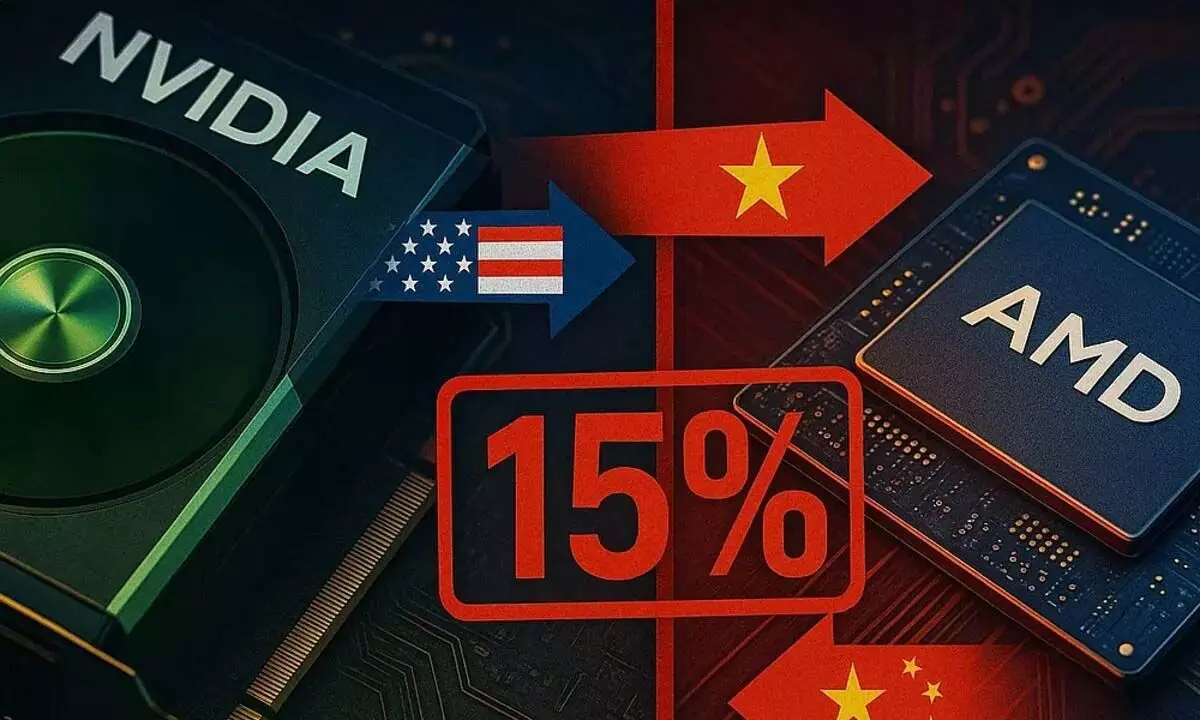

In a surprising move that underscores the complex geopolitical landscape shaping the global semiconductor industry, major players like Nvidia and AMD are now required to contribute 15% of their China-based chip sale revenues to the U.S. government. This development signals a significant shift in how international chip companies are navigating U.S.-China relations, economic policies, and national security concerns.

The backdrop of this decision stems from ongoing tensions between the United States and China, especially regarding technology transfer, intellectual property, and national security. The U.S. government, concerned about the strategic importance of semiconductors, has implemented policies to restrict China’s access to cutting-edge chip technology. In response, Chinese policies have also been designed to bolster domestic chip manufacturing and reduce reliance on foreign suppliers.

The Details of the Revenue Sharing Agreement

According to recent reports, Nvidia and AMD are now obligated to pay 15% of their revenues from chip sales in China to the U.S. government. This move comes amidst broader efforts by Washington to exert influence over foreign companies operating within China, especially those in high-tech sectors such as semiconductors.

This revenue-sharing mechanism aims to achieve several strategic objectives:

- Economic Leverage: It grants the U.S. a financial stake in the profits generated by foreign companies from their operations in China.

- National Security: This policy is rooted in concerns that profits derived from Chinese sales could inadvertently support military or surveillance applications that threaten U.S. interests.

- Market Control: It represents a form of market regulation, ensuring U.S. technology firms remain aligned with American economic and strategic objectives.

Implications for Nvidia and AMD

While the immediate financial impact might seem limited relative to the firms’ overall revenues, the policy sets a precedent that could influence the operations of other tech giants. For Nvidia and AMD, the obligation to share a sizeable portion of Chinese revenue might lead to:

- Reconsideration of Chinese Market Strategies: Companies might evaluate the costs and benefits of continuing aggressive market penetration in China.

- Operational Adjustments: Adjustments might be needed in their sales and distribution channels to comply with regulatory requirements.

- Potential Shift in Pricing Models: With added costs, companies could reconsider their pricing strategies in Chinese markets to maintain competitiveness.

Broader Industry and Geopolitical Impacts

The U.S. Policy as a Strategic Tool

The move to impose a 15% revenue share reflects a broader strategic approach by the U.S. government to regain influence over global chip supply chains, especially in light of China’s pursuit of self-sufficiency in semiconductors. It can be viewed as part of the larger effort to restrict China’s access to advanced technological components, thereby maintaining U.S. technological dominance.

Chinese Response and Resilience

China has been actively investing in domestic semiconductor research and development. The revenue sharing policy might accelerate Chinese efforts to establish a more self-reliant industry to mitigate the impact of such policies. Chinese firms and policymakers could seek alternative markets or develop indigenous chip manufacturing capabilities to reduce dependence on foreign companies like Nvidia and AMD.

Legal and Ethical Considerations

Implementing such revenue sharing policies raises questions about international trade laws, sovereignty, and fairness. Critics argue that compelling companies to pay a portion of their foreign revenue could hinder free-market principles. Conversely, proponents see it as a necessary step to protect national security interests and ensure fair contribution from foreign companies benefiting from the Chinese market.

What the Future Holds

The relationship between U.S. policies and the strategies of multinational tech companies is complex and dynamic. As geopolitical tensions persist, similar revenue sharing or profit-sharing arrangements could become more common. Companies will need to balance their global growth ambitions with compliance to local and international regulations.

Furthermore, policymakers worldwide will watch this development closely, as it may influence future international trade negotiations and tech diplomacy efforts.

Conclusion

The decision for Nvidia and AMD to allocate 15% of their China chip sales revenue to the U.S. government underlines the heightened intersection of technology, geopolitics, and economics in today’s world. While this move could pose challenges for multinational corporations operating in China, it also offers a glimpse into how governments are increasingly asserting influence over critical global industries.

Businesses and consumers alike should stay informed about these policy shifts, as they will likely shape the future landscape of the semiconductor industry and international trade.

In summary: As global powers navigate this new era of technological competition, understanding these policies’ implications will be key for stakeholders at all levels—from corporate strategists to everyday consumers.

For more updated news please keep visiting Prime News World.