In recent months, a notable shift has been observed in the global financial landscape. Traditionally, the United States has been regarded as the ultimate safe haven for investors during times of crisis, geopolitical tension, or economic uncertainty. However, recent reports indicate that this phenomenon is experiencing a decline, leading to an increased flow of capital into Europe and Asia. This emerging trend marks a significant transformation in international investment behaviors and has profound implications for global economic dynamics.

Understanding the US Safe Haven Paradigm

Historical Context of US Safe Haven Status

The US dollar and US Treasury securities have long held a dominant position as safe assets in the global financial markets. During periods of global turmoil—be it geopolitical conflicts, recession fears, or currency instability—investors flock towards American assets, perceiving them as secure refuges that protect capital and ensure stability.

This status is reinforced by the size and strength of the US economy, its deep and liquid financial markets, and the dollar’s role as the world’s primary reserve currency. Such factors have cemented the US’s position as the go-to destination for investors seeking safety.

Challenges to US Safe Haven Dominance

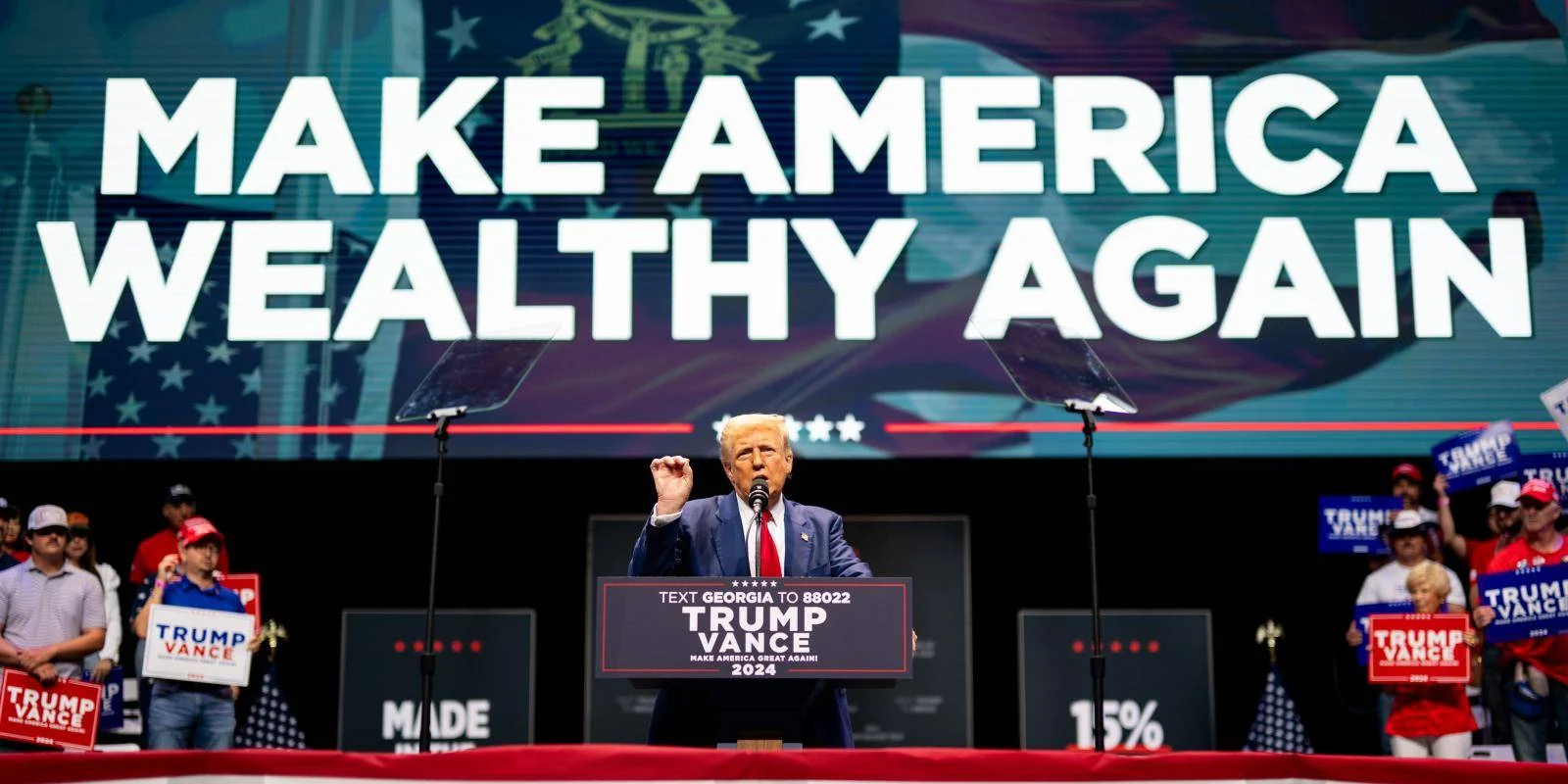

However, recent developments suggest that the US’s dominance as a safe haven is waning. Increasing fiscal deficits, political uncertainties, and monetary policy debates have begun to erode confidence in US assets. Furthermore, global geopolitical tensions and the rise of alternative regional powers are promoting diversification of investment strategies.

As a result, investors are re-evaluating their safe haven options, leading to a redistribution of capital towards other regions—primarily Europe and Asia—where economic resilience or strategic opportunities appear more promising.

Factors Driving the Shift Toward Europe and Asia

Economic Stability and Growth Prospects

- Europe: Despite its own challenges, Europe has demonstrated resilience through coordinated monetary policies, fiscal measures, and structural reforms. Countries like Germany and the Nordic nations are viewed as bastions of stability with robust banking systems.

- Asia: Rapid economic growth, technological innovation, and increasing geopolitical influence, particularly from China and India, position Asian economies as attractive alternatives for risk-averse investors.

Geopolitical and Political Developments

Persistent geopolitical tensions involving the US, such as trade disputes and diplomatic conflicts, have prompted investors to seek safer or more stable environments elsewhere. Europe, with its relatively predictable political landscape, and Asia, with emerging regional cooperation, present alternative destinations for capital preservation.

Currency Dynamics and Financial Markets

Currency fluctuations and the relative strength of the US dollar also play a vital role. When the dollar weakens, US assets become less attractive, prompting investors to diversify into other currencies and markets. Additionally, burgeoning bond and equity markets across Europe and Asia offer compelling returns, encouraging capital inflows.

Implications for Global Financial Markets

Impact on US Markets

The declining influx of capital into US assets could lead to increased volatility and potentially rising borrowing costs. If international investors continue to withdraw or diversify away from US holdings, it may influence the stock and bond markets, and even the broader economy.

Emergence of European and Asian Markets

The capital shift benefits Europe and Asia, fostering growth and development. It encourages these regions to deepen their financial markets, implement reforms, and attract foreign direct investment. This, in turn, could lead to enhanced economic stability and geopolitical influence.

Global Power Dynamics

The redistribution of investment flows signifies a potential reshaping of economic power. As Europe and Asia gain prominence in global finance, the traditional US-led economic order may evolve, ushering in a more multipolar financial environment.

Future Outlook

The ongoing trend suggests that the global economy is entering a phase of diversification. Investors are increasingly seeking regional stability and growth prospects rather than relying solely on US assets. While the US will undoubtedly remain a critical player, its position as the unrivaled safe haven appears to be diminishing.

Policymakers in Europe and Asia are aware of this shift and are actively working to improve their financial infrastructure, governance, and transparency to attract even more foreign capital.

However, uncertainties remain, including geopolitical risks, economic policies, and global health crises, which could influence future capital flows. Nonetheless, the emerging pattern indicates a more balanced and fluid global financial ecosystem.

Conclusion

The diminishing allure of the US as the ultimate safe haven is a transformative development in global finance. Capital is increasingly flowing toward Europe and Asia, driven by their economic resilience, strategic opportunities, and relative political stability. As this trend continues, it will reshape not only investment patterns but also the geopolitical landscape, emphasizing the importance of regional stability and economic reforms.

Investors, policymakers, and financial institutions must stay vigilant and adaptable to navigate this evolving environment effectively.

Summary of Key Points

- US Safe Haven Status Is Waning: Increasing fiscal and political uncertainties diminish investor confidence.

- Europe and Asia Are Gaining: Strong economic growth and stability attract global capital.

- Regional Factors Drive Capital Flows: Market resilience, currency movements, and geopolitical dynamics matter.

- Global Power Shifts: Diversification indicates a move toward a more multipolar financial world.

- Future Prospects: Ongoing reforms and geopolitical developments will influence the trajectory of capital movements.

In conclusion, the global financial landscape is poised for significant change, with Europe and Asia taking center stage as key beneficiaries of the US’s diminishing safe haven appeal. This shift underscores the importance of regional stability and open markets in shaping future investment strategies.

For more updated news please keep visiting Prime News World.