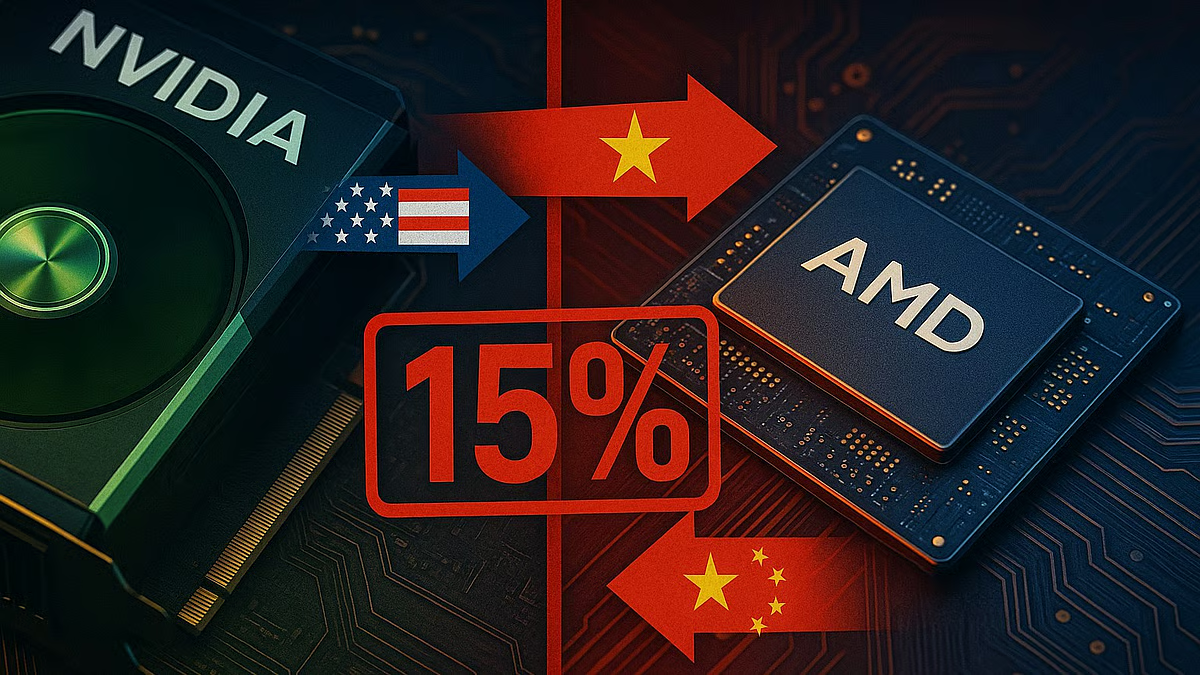

The global tech industry is witnessing a significant policy shift that could reshape the financial landscape for leading chip manufacturers. Recent reports highlight that two of the giants in this sector, Nvidia and AMD, are now mandated to pay a 15% revenue tax on in China to the United States. This development underscores evolving international tax regulations and the strategic considerations that tech corporations must navigate in a rapidly globalizing economy.

Background: The Changing Dynamics of International Taxation for Tech Giants

Over the last decade, the semiconductor industry has undergone exponential growth, becoming a strategic asset in geopolitical and economic arenas. Nvidia and AMD, as prominent players, have expanded their market footprints across multiple regions, including China—one of the largest markets for semiconductors and electronics.

The implementation of a 15% revenue tax signifies a new chapter in how governments view and approach multinational corporations, especially in high-tech sectors that influence both the economy and national security. As countries seek to ensure they receive appropriate fiscal contributions from global companies operating within their borders, new tax policies are emerging to address these complexities.

The Details of the New Tax Obligation

What does the 15% Revenue Tax entail?

This policy mandates that companies like Nvidia and AMD report and remit 15% of their revenue generated within China back to the U.S. government. Unlike traditional corporate taxes levied on profits, this revenue-based tax applies directly to the gross income derived from Chinese operations.

This approach is part of broader efforts by the U.S. to ensure that American companies adequately contribute to their home country’s treasury processes, even when operating abroad. Notably, this revenue tax is in addition to standard corporate taxes that the companies might pay locally in China.

Impacts on Nvidia and AMD

- Financial implications: The companies will now allocate a significant portion of their Chinese revenue to the U.S., potentially influencing their profit margins and investment strategies.

- Operational adjustments: To optimize tax liability, Nvidia and AMD may reconsider certain operational strategies, such as regional partnerships, revenue recognition methods, and supply chain configurations.

- Market strategies: The new tax could influence how aggressively each company pursues growth opportunities within China, balancing between market expansion and tax efficiency.

Broader Geopolitical Context

This development cannot be viewed solely through a financial lens; it is deeply intertwined with the evolving geopolitical climate. Tensions between China and the United States have intensified over issues related to trade, technology transfer, and national security. The tech sector, especially chip manufacturing, has become a frontline in these conflicts, with each side seeking to protect and advance its strategic interests.

The decision to enforce a 15% revenue tax is likely influenced by these broader tensions. The U.S. aims to ensure that its economic interests are safeguarded and that American innovators are fairly compensated regardless of where their revenue is generated. Conversely, China is increasingly vigilant about protecting its domestic industry and ensuring that foreign companies contribute proportionately to its economy.

Possible Consequences for the Semiconductor Industry

Shifts in Investment and R&D

With increased fiscal obligations, companies like Nvidia and AMD might adjust their investment in research and development. Some potential outcomes include:

- Reduced reinvestment: Higher tax burdens could lead companies to cut back on innovation initiatives or delay new product launches.

- Strategic realignment: Firms may explore new markets or diversify their revenue streams to offset China-related tax liabilities.

- Increased focus on supply chain efficiency: To maintain profitability, companies may streamline their operations and sourcing strategies.

Impact on Global Supply Chains

As the chip industry heavily relies on complex global supply chains, the new tax regulation could prompt shifts in sourcing and manufacturing. Companies might consider relocating or expanding manufacturing sites outside China, such as in Southeast Asia or other regions, to mitigate tax impact and ensure smoother international operations.

What Does This Mean for Consumers and the Tech Market?

While the primary impact is on corporate financials and strategy, there are downstream effects on consumers and the broader tech marketplace:

- Potential price adjustments: Increased costs could be passed on to consumers in the form of higher prices for devices that rely on Nvidia and AMD chips.

- Supply considerations: Any disruptions or shifts in production could impact product availability and launch timelines.

- Innovation trajectory: Budget reallocations may influence the pace and scope of innovation in high-performance computing and gaming sectors.

Looking Ahead: The Future of US-China Tech Revenue Policies

As the global economy continues to evolve, the framework for taxing international revenues will remain dynamic. The Nvidia and AMD case serves as a precedent for increased scrutiny and regulation of cross-border digital income. Policymakers in both countries may introduce further measures to balance economic sovereignty with the realities of multinational operations.

Additionally, this policy shift might inspire other nations to adopt similar revenue-based taxation models, leading to a patchwork of regulations that companies must navigate skillfully.

Conclusion

The requirement for Nvidia and AMD to pay 15% of their Chinese revenue to the U.S. marks a significant development in international corporate taxation, especially within the high-tech sector. It reflects geopolitical tensions, shifts in economic policies, and the need for corporations to adapt to an increasingly complex global regulatory environment. While challenges lie ahead, this evolution also presents opportunities for strategic reorientation and innovation in the semiconductor industry.

In the broader picture, these policies underscore the importance of transparency, compliance, and agility for multinational corporations striving to thrive amid geopolitical and global economic shifts.

For more updated news please keep visiting Prime News World.