UK Housing Market Highlights

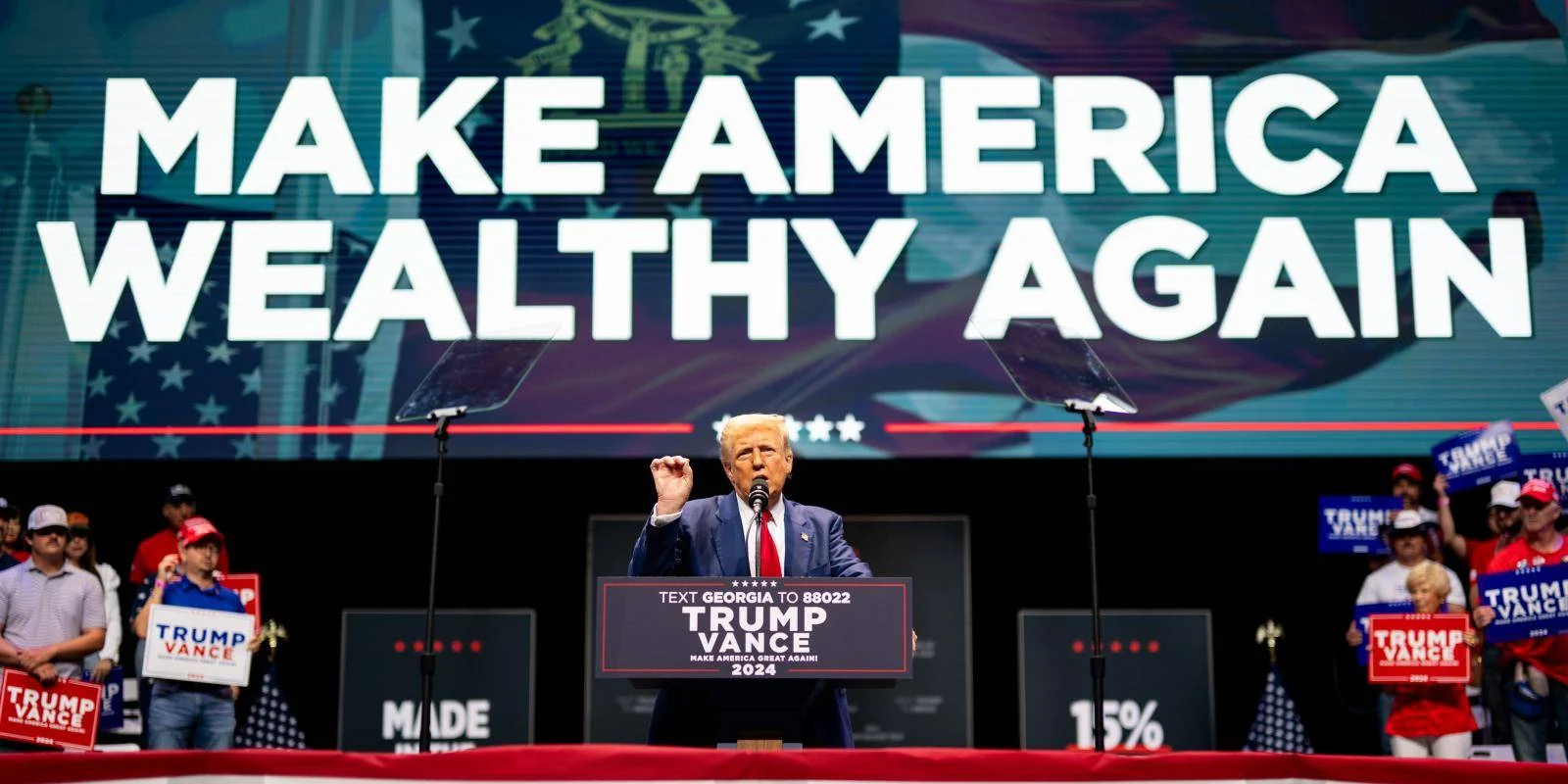

The past few weeks have showcased a fascinating juxtaposition in the global economic landscape. In the United Kingdom, the housing market has demonstrated resilience by experiencing a **2.4% increase** in property prices. Meanwhile, international financial markets, including the FTSE 100 index, have faced significant declines amid geopolitical and trade tensions, notably the announcement of new tariffs by the United States under President Donald Trump. This divergence highlights the complex interactions between domestic economic fundamentals and international trade policies, which together influence investor sentiment, consumer confidence, and market stability.

The Rise in UK Housing Prices: What’s Behind the Surge?

Despite the turbulent international scene, the UK housing market continues to show strength. Several factors contribute to this steady rise in property prices:

Economic Fundamentals and Consumer Confidence

The UK has maintained relatively steady economic indicators, supported by low unemployment rates and moderate inflation, fostering an environment where consumers feel confident to invest in property. Banking institutions have also maintained accessible mortgage rates, enabling buyers to enter the market more easily.

Supply and Demand Dynamics

The demand for housing in key cities like London, Manchester, and Birmingham remains high, driven by a growing population and continued urbanization. Meanwhile, housing supply constraints—due to planning restrictions, a limited inventory of available homes, and delays in new construction projects—have kept upward pressure on prices.

Interest Rates and Monetary Policy

The Bank of England’s consistent stance on low interest rates encourages borrowing, further fueling property demand. Investors and homebuyers see real estate as a secure and appreciating asset, especially during periods of international market volatility.

Impact of Domestic Political Climate

Political stability and ongoing government initiatives to support homeownership—such as stamp duty reductions or schemes aiding first-time buyers—are also instrumental in sustaining the housing market momentum.

International Market Turmoil: Falling Stock Markets Amid Tariff Announcements

While the UK’s property sector thrives, global financial markets face headwinds triggered by geopolitical uncertainties and trade tensions. The recent announcement of new tariffs by President Trump has sent shockwaves across stock exchanges worldwide.

The Effect of Trump’s Tariffs on Global Markets

The introduction of additional tariffs—particularly targeting key trading partners like China and the European Union—has heightened fears of a potential trade war. Investors, reacting to these policy shifts, have pulled back from riskier assets, leading to a decline in major indices such as the FTSE 100, Dow Jones, and others.

Market Reactions and Investor Sentiment

The FTSE 100 experienced a notable fall, reflecting diminished investor confidence. The dip underscores concerns over disrupted global supply chains, increased costs for exporters, and overall economic slowdown prospects.

Correlation with US-China Trade Tensions

Trade tensions between the world’s two largest economies have a ripple effect, affecting currencies, commodity prices, and business investment plans worldwide. This environment complicates economic outlooks, compelling policymakers to tread carefully.

Interplay Between the Housing Market and Stock Markets

Interestingly, despite the dour mood in stock markets, UK housing prices are continuing their upward trajectory. This divergence can be explained through several perspectives:

- Safe-Haven Investments: During times of stock market stress, investors often shift towards tangible assets such as real estate, perceived as safer long-term investments.

- Lower Correlation: Historically, property prices and stock markets exhibit varied correlation patterns, with real estate often insulated from short-term stock market shocks.

- Domestic Factors Take Precedence: Local economic stability and demand-supply mechanics in the UK are strong enough to buffer the impact of international uncertainties.

Implications for Buyers, Investors, and Policymakers

The current scenario offers multifaceted insights:

For Homebuyers

The rising property prices imply that acquiring a home remains a significant investment, especially for first-time buyers who can benefit from government schemes. However, affordability may become a concern as prices outpace wages in some regions.

For Investors

Real estate presents a resilient asset class amid volatile global markets. Investors contemplating diversification might view UK property as an attractive alternative to equities, especially with the current geopolitical tensions.

For Policymakers

The government and monetary authorities need to balance fostering growth in the housing sector while ensuring financial stability. Addressing affordability and supply constraints could prevent overheating in specific markets, while maintaining openness to international trade to mitigate external shocks.

Looking Ahead: What Should Market Participants Expect?

Given the current dynamics, several scenarios are plausible:

– Continued resilience in UK house prices, supported by underlying demand and limited supply.

– Possible slowdown if global uncertainties escalate, impacting investor confidence.

– Potential policy interventions aimed at stabilizing markets and promoting affordable housing.

Monitoring international trade developments and domestic economic policies will be crucial for stakeholders seeking to gauge the direction of both property and financial markets.

Conclusion: Navigating a Complex and Interconnected Economy

The juxtaposition of rising UK housing prices amid declining stock markets underscores the nuanced and interconnected nature of today’s global economy. While local market fundamentals shield the UK housing sector from immediate shocks, international tensions remain a significant concern for investors and policymakers alike.

Understanding these trends can help individuals and institutions make informed decisions, balancing risk and opportunity in an uncertain environment. As the situation evolves, staying informed through reliable news sources and expert analyses will be vital in navigating this complex economic terrain.

For more updated news please keep visiting Prime News World.